Every day, from Monday to Friday, millions of Indians engage in a gritty battle. While most days it may be uneventful or of limited consequences at a broader level, there are always pockets of action in the war zone where something significant is happening that makes some participants wealthy and a few others poorer. And then, of course, there are those odd days when there is the painful ‘blood in street’ or triumphant ‘to the moon’ kind of moves across the board. The battle that begins at 9.15 a.m. rages on till 3.30 p.m., only to begin again the next day! But what exactly is the battle over?

It’s all about identifying the fair value of a stock, which is probably the most enigmatic of all battles. For every LIC or GQG Partners bullish on Adani group stocks, there is a Hindenburg with an equally strong bearish view. As fundamental investors slug it out, there are other competing forces too — such as technical investing, momentum investing or passive investing — that strongly influence the course of events, causing further ‘distortions’ in price versus value.

Amidst this big combat that large players indulge in, there are also small battles. How then do you have stock markets where millions and millions of transactions take place every day, tick by tick, in which for every seller who thinks he/she is getting a good exit price, there is a buyer who thinks he/she is getting a good entry price! Besides compulsions on need to liquidate (in case of a seller) and need to park excess cash (in case of buyer), how exactly do they determine the price at which to sell/exit?

As they say, No Two Doctors agree, No Two Lawyers agree, and No Two Astrologers agree. If this saying is to be modified to today’s world, one can also add, “No Two Investors/ Analysts agree”.

For, valuation is an art that nearly every fundamental investor attempts, but very few succeed in. Those who succeed in it better than others end up being super-wealthy.

But first, what is valuation?

Never has there been a starker contrast between the definition of something and actually understanding it. Definition of value of a stock, according to market experts like Warren Buffett or Aswath Damodaran is so simple – it is the net present value of all the future cash flows the asset can generate. This, in other words, represents the ‘intrinsic value’ of a stock that Warren Buffett gives utmost importance to. At the same time, Buffett also points out that ‘this is a number that is impossible to pinpoint, but essential to estimate.’ Thus arriving at the value of a stock is rarely as simple as its definition.

So why engage in such a complex task of valuation?

It’s January 2015. Famed Hedge Fund Manager Bill Ackman is on top of the world. His firm, Pershing Square, made it to the list of top 20 global hedge funds for generating net gains of $4.5 billion in 2014. This represented 40 per cent of the cumulative gains generated by the company in the 10 years prior to 2014. With a 11-year history for the firm, and Bill Ackman at 48, both were youngest in the elite league.

However, just a little over a year later, the tables were turned completely. Bill Ackman’s massive bet on Valeant Pharmaceuticals had gone awfully wrong and Pershing Square ended up booking more than $3 billion loss in just that one position. Pershing Square Holdings, which was listed in the markets, dropped by more than 50 per cent from early 2015 to early 2016. A single bet undid many years of success, and it took around four years to claw back from the losses.

In an introspective interview after exiting his Valeant position at a 90 per cent loss, Bill Ackman lamented that this was the only time he broke all his investment rules. Typically, Pershing Square’s strategy was to buy concentrated positions in undervalued (relative to intrinsic value) quality companies whose business they could dissect and understand by just delving into their 10Ks (similar to annual reports) and predict future cash flows with a reasonable degree of confidence.

But in the case of Valeant, they deviated from their investment philosophies by originally partnering with them to make an acquisition and based on their comfort with management taking a position in the company without doing their traditional research/valuation-based approach.

The lesson? — A disciplined, rule-based approach to valuation matters. The dean of valuation, Aswath Damodaran, refers to valuation as a life vest that he can hold on to during times of turbulence. According to him, given the biases humans are loaded with, investors will find a rationale to justify buying or selling a stock under any circumstances. Valuation ‘slows the process down, gives your rational side a chance to mount an argument.’

One mistake based on a biased decision can undo years of gains, as even one of the world’s best investors like Bill Ackman realised. If the best in breed can err so much, what about the rest?

Hence, the need for valuation and process-driven approach to investing! Your valuation approach might dissuade you from buying the hot stocks that markets are crazy about. And once in a while, one of the frenzied hot stocks might even become a genuine multibagger, as was the case with Tesla, but it would also have protected you from losing 90 to 100 per cent of your money — by preventing you from investing in multiple other stocks that crashed. In the investing world, errors of omission are better than errors of commission. That’s the path that Warren Buffett took to become one of the richest persons in the world.

Ultimately, success in investing is best measured end-to-end across a cycle, or more so like from the start of one bear market to end of the next bear market. During intervening parts of the cycle it might appear like anything and everything is going up and valuations don’t matter. But just reserve your judgement till the cycle is complete!

Now that we have understood why valuation is important, how should you go about it?

The art of valuation

Broadly there are two main approaches to valuation – Absolute and Relative valuation

The absolute approach involves determining the intrinsic value of a company. Here too, there are two common approaches – a discounted cash flow method or the DCF, and the dividend discount model or the DDM. The crux here is to determine how much cash you can extract out of the company over its entire life cycle and, more importantly, what is all that cash worth as of today.

What exactly is the logic here? When it comes to cash-generating assets you have many options. For example, instead of investing ₹10,000 today in, say, shares of a TCS or Reliance with an investment horizon of 10 years, you could invest in risk-free Indian government 10-year bond that will pay you 7.2 per cent per annum as well as return the principal of ₹10,000 at the end of 10 years. For simplicity’s sake, let’s assume the 7.2 per cent is adequate compensation for inflation over this period. The net present value (NPV) of the cash flows you receive — the interest every year + principal at the end of 10 years — is ₹10,000.

Your savings are preserved and protected against inflation. Is the investment in equity going to better that? Are the cash flows you are going to receive over the next 10 years as dividends and your exit price at the end of the period, better than the NPV of the bond? A DCF attempts to arrive at the answer.

A DCF involves estimating three main variables – annual cash flows over the relevant time period (in this case 10 years), the cost of equity or expected rate of return (the annual discounting rate applied to the cash flows), and the terminal value (at the end of 10 years) or alternatively the terminal growth rate.

Do note that to arrive at these three major variables there are many other sub-variables that you will need to estimate. For example, in assessing the annual cash flows, you need to evaluate the revenue, costs/margins to arrive at the annual profits/cash flows. Tweaking just one variable will change the valuation you arrive at based on a DCF model. For instance, the revenue of a telecom company will depend on your estimate of number of subscribers and the ARPU. The revenue can change depending on changes you make to one of these alone and that will have an impact on the final valuation.

Here’s an illustration. At bl.portfolio, when we worked out a DCF model for a company with predictable cash flows like TCS, it was hard to justify current value for the stock even assuming the company is able to grow its earnings/ free cash flows at 10 per cent for the next 10 years (last 5 years earnings/free cash flow CAGR was at 10 per cent). Assuming a terminal exit value (tenth year end PE of 20 times), expected rate of return of 12.2 per cent (risk free rate of 7.2 + equity risk premium of 5 per cent), its present value we arrived at was ₹2,700. This implies the stock is 33 per cent overvalued today and the investor is better off parking money in the risk free 7.2 per cent 10-year government bond.

However, do note, the above is not a recommendation. The objective is to provide a perspective of how DCF models work. Say, for example, if you as an investor are ready to lower your expected return over risk free rate to just 2 per cent (i.e. expected rate of return of 9.2 per cent), the current TCS value may seem fair. Further if in your estimate, the next 10 years earnings CAGR for TCS can be above 10 per cent, the value you arrive at will be higher .So what is fair value depends on multiple factors. Also in a 10 year DCF model, same tweak to assumptions but done in different years, will result in a different valuation.

One important thing to note is that the value of a stock can be computed by either building an equity DCF model (cash flows attributable to equity shareholders) or by building a firm DCF model. In the latter, you will arrive at Enterprise Value or EV of the firm, and the equity value will be EV minus net debt.

Dividend Discount Model

If the discounted cash flow method or the DCF sounds complicated, there is a simpler option — the Dividend Discount Model or DDM approach to valuing stocks. When you buy a stock, the cash you can take out of it is the dividends you get and the price you exit it at, after a specified time period (your terminal exit value as mentioned above). What is the basis for determining the terminal exit value? In the DDM approach, the assumption is that the terminal value too is determined by expected future dividends at the time of exit.

Thus, under DDM, the value of a stock is the NPV of dividends attributable to it till eternity.

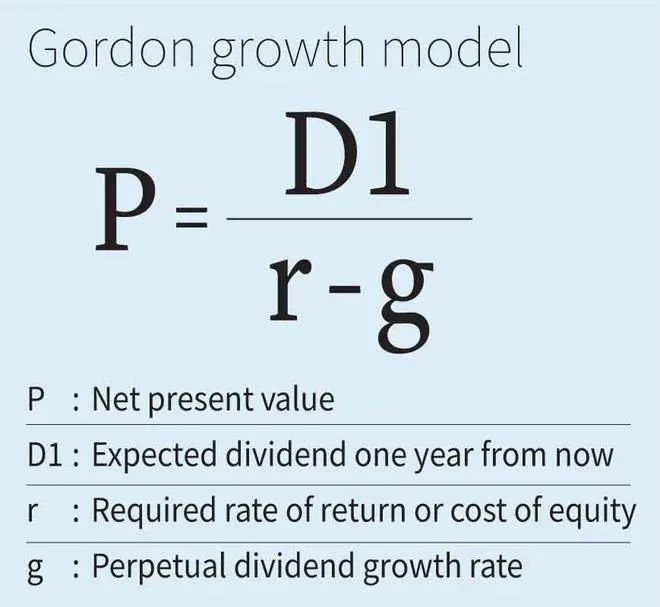

However, what is more commonly used is a variation of this called the Gordon Growth Model (see image) The required rate of return here is the same as the risk free rate + ERP, while the dividend growth rate is the perpetual dividend growth rate.

This method of valuing stocks can be attempted for stocks that investors prefer for their dividend yield. Taking the same example of TCS, we can assess whether the stock is over or under valued based on GGM.The company has a policy of returning 80 to 100 per cent of free cash flows to shareholders every year. While buyback is also a route to return money, it is effectively not different from dividends assuming investors tender their shares. Based on this assumption, its cash dividends/returns to shareholders will be around ₹110 in FY24 (90 per cent payout ratio), implying a dividend yield of 3.2 per cent. Perpetual growth will typically be the equivalent of GDP growth. Considering TCS business is global, its perpetual growth will be more in sync with global GDP growth rate which can trend around 2 per cent in the long term. If we make this assumption and add to it expectations of required rate of return of 12.2 per cent, then under this formula the value of TCS share is only ₹1,100. But wait, nothing to get alarmed here, the stark difference can be explained by the fact that TCS is expected to grow earnings at around 10 per cent for the next few years.

However, we can use this GGM formula to assess what is the perpetual growth rate at which current share price of TCS can be justified. Filling the blanks, the answer is 9 per cent. So a investor buying into TCS must assess whether it can grow its dividends at 9 per cent per annum till eternity. Investors can try this out with different stocks, and also use GGM to arrive at value of mature companies.

Relative Valuation

If the methods discussed here appear out of bounds to you due to paucity of time or complications involved in making estimates and assumptions, markets offer you a relatively easier way out to value stocks – the art of Relative Valuation. But do note the important point — it is only ‘relatively easier’! We will cover this approach in detail in our next week’s Big Story.

For readers interested in exploring deeper the concept of DCF, the online home page of Aswath Damodaran offers a treasure trove of data. You can also check out many model spreadsheets available in this link.

A DCF valuation model is like a digital toy for investment enthusiasts to explore and learn from!