Even as consumer price inflation continues to be above the Reserve Bank of India’s (RBI’s) comfort zone, the RBI is still expected to keep interest rates on hold for the foreseeable future. Globally, however, Central Banks continue to remain hawkish, with the fight against inflation and a tight labour market still on. Yields on treasury securities are surging to record levels in the US, sparking a tightening of yields on sovereign securities in several economies. Closer home, India’s 10-year g-sec yields have risen in recent months to 7.26 per cent levels.

This increase has had a ripple effect on tax-free bonds as well. Yields have risen to attractive levels and present attractive investment options for investors.

There is very little risk involved while investing in these bonds as these are issued mostly by AAA-rated public sector companies.

However, it is important to note that such bonds are ideally suited for those investors in the higher tax brackets – 30 per cent and higher – given that the interest received is tax free.

Here are three tax-free bonds for investors in higher slabs.

Bonds that yield more

We have considered a few key factors before selecting these tax-free bonds. Liquidity and frequency of trading are important aspects to be considered. Only those bonds that are traded almost daily and have volume of at least many thousands to a few lakh rupees at least are taken for consideration. Also, only those that give yields of 5.5 per cent or higher when held till maturity from the current levels are preferred.

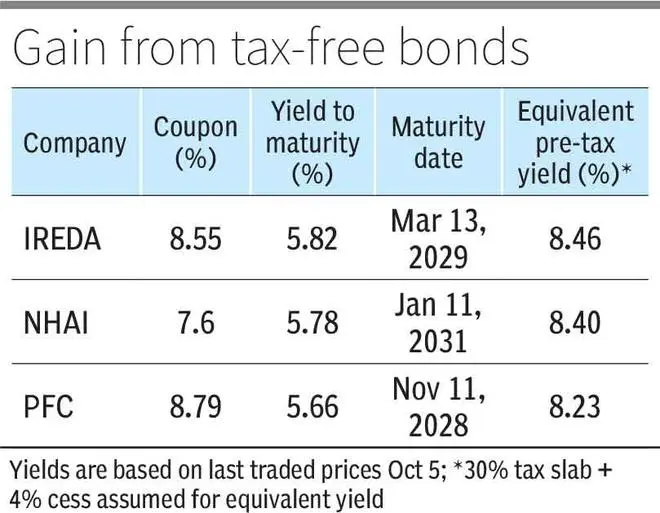

The tax-free bonds of IREDA, NHAI and PFC are attractive options to consider. The residual maturity or the time left for these bonds to mature ranged at 5.5-7.5 years.

On an equivalent pre-tax basis, for those in the 30 per cent tax bracket (plus 4 per cent cess), these tax-free bonds yield 8.23-8.46 per cent.

At these rates, the bonds compare favourably with deposits of larger public and private sector banks of comparable tenor. A bank fixed deposit that pays 8 per cent interest would result in a post-tax return of 5.5 per cent. For tenors of five or more years, there are hardly any large banks offering 8 per cent or more.

The g-sec that matures in 2028 trades at an yield of 7.26 per cent. Post-tax returns would be much lower.

Thus, the tax-free bonds offer rates that compare favourably with the best options among g-secs, deposits of banks and NBFCs and even highly-rated debentures.

These tax-free bonds may not suit those in the lower tax brackets. Especially those in the 5 or 20 per cent slabs, as the equivalent pre-tax return would be low.

Understanding bond trades

All interest paid in tax-free bonds is just that – completely tax free.

Investors must understand the different terms used in bonds to getter a better grip of the returns earned. There are coupon rates and there are yields. Coupon rate is the interest paid on the face value of the bond, usually on ₹1,000.

The yield-to-maturity is the return you would get if you bought the bond now and held it till its maturity. The bond price is critical here. That’s why liquidity and frequency of trading are important.

Buying it at a higher or lower price, or selling these bonds before maturity will alter the yield significantly.

Also, higher yields hold for investments of up to ₹10 lakh. If you invest more than ₹10 lakh, the coupon rate is reduced by 10-25 basis points in certain cases. You can restrict your investment to less than ₹10 lakh to make the most of it.

Safe issuers

Select public sector companies and a few other firms were allowed by the government (2014-15) to raise bonds where the interest received wouldn’t be taxed. These bonds were issued for time frames ranging from 10 to 20 years.

But, over the past several years, tax free bonds have not been issued. The available bonds in the category are traded on the exchanges.

These bonds are issued by government companies that are ‘Miniratnas’ involved in funding developmental projects. All of them are rated AAA by at least one of the three prominent credit rating agencies – CRISIL, ICRA and CARE.

There is also the government’s implicit backing in place. Therefore, these bonds carry very low credit risk. None of these firms has ever defaulted on interest or principal payments to bond investors.

The net non-performing assets (NPAs) of these companies are at 1-2 per cent as of FY23. This appears to be largely under control.