There are many similarities between ICICI Bank and Axis Bank. For one, they were once known as corporate loan-heavy banks.

In 2015, when the asset quality issue hit the sector, both were the most impacted among the private sector banks. Around the same time, ICICI and Axis saw changes in leadership. What was possibly different was the circumstances under which these changes happened and the choice of leaders. While ICICI Bank stood by its oldtimer and a veteran internal hand for the MD & CEO’s role, Axis Bank took a bet on an insurance sector specialist.

But whether it is Sandeep Bakhshi of ICICI Bank or Amitabh Chaudhry of Axis Bank, they have been much required ‘change agents’ for the banks. They have altered their portfolios in a manner that the corporate lenders tag may not fit them any longer.

This sharp renewed strategy is reflecting on their stock prices as well.

Axis Bank and ICICI Bank have returned 143 per cent and 167 per cent gains in the last three years respectively.

Along with it, a very unusual thing has also happened.

Historically, Axis Bank has traded at a premium to ICICI Bank, owing to some of its underlying approach in the business, especially prior to 2018. Now, the tables have reversed. ICICI Bank has overtaken Axis by a large margin in terms of valuations.

Trading at over 2.3x FY24 expected price to book, multiples of Axis Bank, the third largest private bank, is at 30 per cent discount to its immediate peer.

The stark change in relative multiples warrants a relook on how investors should approach these stocks.

In February 2023, bl.portfolio had recommended that investors ‘buy’ ICICI Bank. Since then, the stock has appreciated 30 per cent. With triggers for rerating in the near term (12-18 months) not very prominent, investors could consider booking profit on the stock.

On the other hand, Axis Bank, at the current multiples, despite a huge run-up in its stock price in the last one year (44 per cent), seems relatively attractive to ICICI Bank. The bank’s peak multiples have been around 2.9-3.1x price to book. Considering that the current valuation is a discount to its historic levels, investors could accumulate Axis Bank stock.

Do note: Since ICICI and Axis are heavyweight private sector players benefiting from the management changes that have unfolded in the last five years, it may be prudent for investors, especially those wanting to have greater representation of banking stocks in their portfolios, to have both the names in their list.

What is recommended, though, is a shift or re-balancing between the two stocks; that is, investors who have held ICICI Bank for over a year or so, could take some profits out of the counter and deploy it to accumulate Axis Bank.

Why Axis Bank?

Axis could have an edge over ICICI Bank in the coming quarters for the following reasons:

Profitability

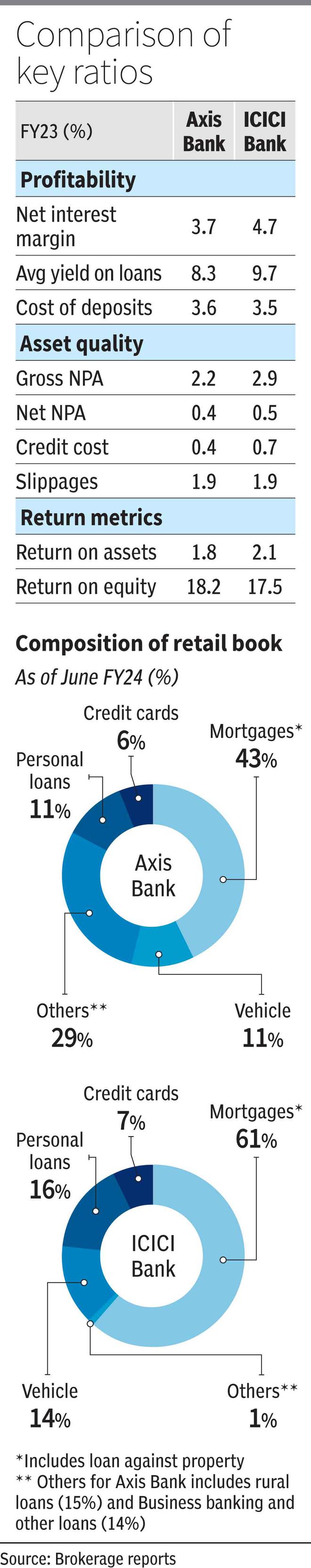

At 4.1 per cent net interest margin (NIM) in Q1 FY24, which is a measure of profitability, Axis Bank is among the laggards in the top five private banks peer set. This is despite NIMs increasing from 3.3 per cent in FY22. At 4.8 per cent in Q1, ICICI Bank’s NIM are ahead of Axis Bank. Being a function of assets and liabilities mix, further improvement in NIM would depend on ability of banks to push high yielding products (mainly unsecured retail loans such as credit cards, personal loans and microfinance loans) and repricing of deposits.

Though ICICI Bank and Axis Bank have seen faster growth in unsecured retail products over the last year, vis-à-vis mortgages, the runway from here on seems to be a tad more favourable for Axis Bank in terms of balancing its retail portfolios (see table). With renewed focus on rural banking (mainly MFI loans), though there could be challenges on the cost/liabilities side, Axis Bank’s ability to improve margins (or in the worst case defend margins) may be better than ICICI Bank’s. The full absorption of pain from Citibank India’s retail business in March FY23 quarter also supports Axis’s ability to clearly focus on growth.

Return profile

Consequent to an improvement in the quality of earnings, the room for improvement in the return profile is higher in case of Axis Bank. Banks have witnessed a significant improvement in their return ratios from FY20–FY23 owing to a stark improvement in asset quality due to legacy loans being taken care of and Covid-related pain reasonably absorbed.

From a low of 0.19 per cent return on assets (ROA) and 2.1 per cent return on equity (ROE), Axis Bank climbed to 1.76 per cent ROA and 18.3 per cent ROE in FY23. ICICI Bank’s return profile has also improved during this period. From ROA of 0.77 per cent in FY20 to 2.13 per cent in FY23 and ROE of 8 per cent in FY20 to 18.4 per cent in FY23 the improvement is very significant.

The re-rating in return profile from here on would be a function of improvement in operational efficiencies, given that in terms of slippages or credit cost, Axis and ICICI may just about be at similar threshold (see table). Here is where Axis may have an edge over ICICI, because, until FY23, the operational strengths of the bank haven’t reflected on the numbers yet, positioning the bank at an inflection point.

Therefore the run at Axis Bank has more legs to it, unless an unseen asset quality issue hits the sector, particularly in the unsecured lending space.