At a time when mid and small-cap frenzy is high, it may be a good time for investors to take stock of opportunities outside these overheated spaces. As Mid and small-cap indices turn more expensive than large-cap valuations, and portfolios become too skewed, it may be time for investors with a moderate risk appetite to consider large-cap funds for investments.

Of course, most active large-cap funds have struggled over the past several years even to match, much less beat, standard benchmarks such as the Nifty 50 TRI and S&P BSE 100 TRI.

But a select few have managed to outperform large cap indices and deliver well over the long term.

In this regard, Nippon India Large Cap fund has been a steady outperformer over the years and can be considered by investors for goals that are 5-7 years away. Taking the SIP route to investing would help average costs across market cycles.

Above-average performance

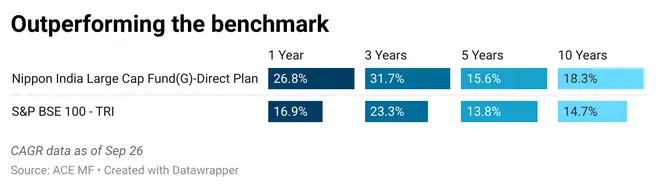

Nippon India Large Cap’s performance has been healthy over the medium to long term. Most active large-cap funds have underperformed benchmarks over the past five years, even on a point-to-point returns basis.

However, Nippon India Large Cap has outperformed the S&P BSE 100 TRI over one, three, five and 10-year periods. The level of outperformance has been to the tune of 2-9 percentage points. The fund has delivered a compounded annual return of 18.3 per cent over the past 10 years, placing it among the best in the category.

SIP returns (XIRR) over the past 10 years have also been impressive, at 16.5 per cent, according to data from Valueresearch.

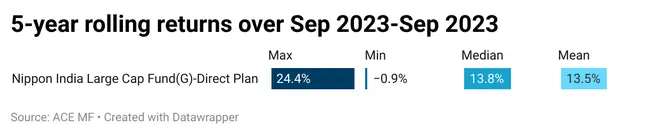

On a five-year rolling returns basis over the period September 2013-September 2023, Nippon India Large Cap has given 13.5 per cent returns on an average, which is higher than its benchmark’s returns. These returns place it higher than peers such as Aditya Birla Sun Life Frontline Equity, UTI Mastershare, HDFC Top 100 and Franklin India Bluechip.

Taking the 5-year rolling data over the September 2013- September 2023 period, the fund has outperformed its benchmark half the time. It has managed to deliver more than 12 per cent returns more than 67 per cent of the time.

The fund has an upside capture ratio of 113.9, indicating that it rises much more than the benchmark S&P BSE 100 TRI during rallies. Its downside capture ratio is 85.4, suggesting that the fund’s NAV falls a lot less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This is based on data from 2020-2023.

Healthy portfolio mix

Active large-cap funds have a rather small universe of 100 stocks to choose from. This constraint results in many funds just hugging the index.

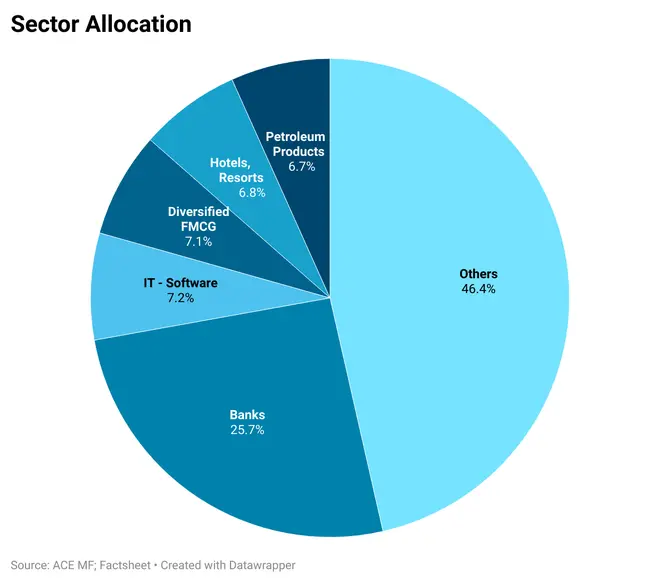

Nippon India Large Cap has managed to juggle sectors and stocks reasonably well over the last several years. Given that it is the large-cap space, the fund takes a blended approach with both value and growth picks.

As with most large-cap funds, banking and finance stocks have dominated the portfolio and have always remained in excess of 30 per cent.

The fund had key allocation to the software segment in the immediate aftermath of COVID-19 and was able to gain from the significant rally in the sector. As valuations rose and business challenges became apparent by early 2022, the fund trimmed exposures. After their relative underperformance over the previous 2-3 years, FMCG stocks, too, have witnessed an increase in takes. Petroleum products and construction are among the other key sector holdings.

One interesting aspect about Nippon India Large Cap is that it invests a bit down the market cap curve as well. For example, it has key exposure to leisure services (essentially hotels) as the post-COVID period and the opening up saw significant ‘revenge’ spending as people rushed to restart work-related travel, take holidays and visit tourism spots, sending room rents and occupancies soaring.

The typical approach of the fund has been to identify the top two or three players in every segment and invest in those companies.

Nippon India Large Cap maintains a compact portfolio of about 55 stocks usually. It does not take cash positions and remains invested across market cycles.

Investors can consider the fund as part of their long-term holdings and take the systematic route to taking exposure.