Iron ore prices will likely rebound over the next couple of months to 2024 despite their recent decline from a 5-month high of $122.2 a tonne in mid-September as the commodity has exhibited resilience against odds.

“Spot iron ore prices have been volatile in the September quarter, but generally moderated since the start of the year, driven by slowing global economic growth and China’s property sector weakness,” said Australia’s Office of the Chief Economist (AOCE).

Research agency BMI, a Fitch Solutions unit, said despite China’s uneven economic growth, blast furnace steel production and iron ore demand have shown a defiance of all odds, through support from non-property sectors including shipping, machinery, autos and infrastructure.

Improved sentiment

“We expect some more upside to iron ore prices in the fourth quarter of 2023 ahead of the winter holidays as steel mills continue restocking,” it said.

ING Think, the economic and financial analysis wing of Dutch multinational services firm ING, said iron ore prices held above the $100-mark in August despite China’s worsening property crisis, which in typical years makes up about 40 per cent of demand. China has continued its efforts to boost the steel-intensive property sector, it said.

AOCE said despite the worsening outlook for global steel demand, iron ore prices strengthened again in September. “The resilience in prices appears to reflect improved market sentiment due to the potential for new government measures to support China’s economy,” it said.

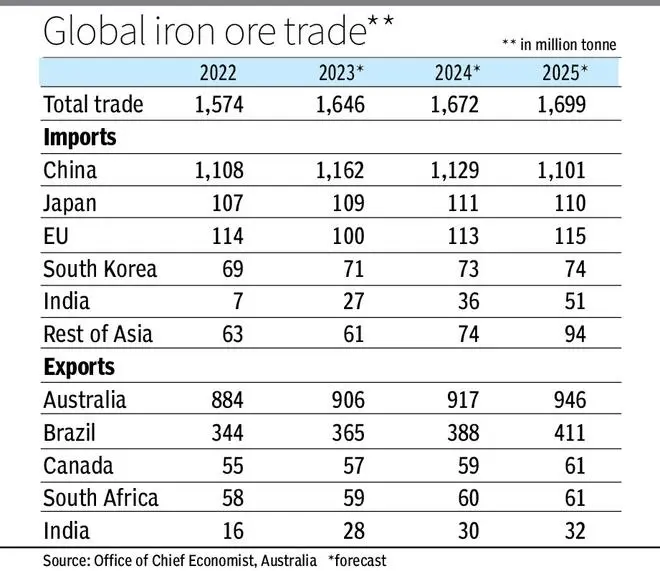

In the first half of 2023, total shipments for the four major exporting countries - Australia, Brazil, South Africa and Canada- were around 666 million tonnes, up 4.4 per cent compared with the same period in 2022.

Fears over Chinese instability

The Trading Economics website, however, said there were mounting concerns over the instability of Chinese property developers. “Missed bond payments by Evergrande and Country Garden triggered fresh fears of financial contagion within the sector, hampering the outlook on construction materials,” it said.

Iron ore prices with 62 per cent iron content are currently quoted at $118.31 a tonne cost and freight, Qingdao, China. Prices are up from $108 witnessed in August.

“We maintain our 2023 iron ore price forecast at an annual average of $110/tonne, but we note strong upside risks to this forecast in light of continued resilience in prices over favourable fundamentals and positive sentiment,” said research agency BMI.

Prices have retained their resilience on the back of strong Chinese imports in 2023 thus far, a result of declining domestic physical inventories at ports, it said.

Port inventories fall

AOCE said restocking of iron ore and steel inventories by Chinese steel mills is expected to provide some support for iron ore demand in the coming months. “In late September, China’s portside iron ore inventories had fallen to around 15 per cent below historic averages,” it said.

BMI said despite the Chinese property sector still being in contraction, positive sentiment was stemming from hopes of a turnaround, with some form of stimulus from the Xi Jinping government.

“Indeed, bank loans surged in August to 1.36 trillion Chinese yuan (CNY), nearly quadrupling from July 2023’s CNY345.9 billion. These indicate that China’s beleaguered property sector may be starting to turn around,” it said.

The Australian Office of the Chief Economist remained optimistic about iron ore demand despite a softening trend in China.

“Strong growth in ex-China iron ore demand over the outlook period (to 2025) is expected from rising steel demand and production capacity in regions such as emerging Asia and the Middle East,” it said.

The outlook included over 100 million tonnes of integrated steelmaking capacity, expected to come online in the next few years in Asia alone.

BMI said on the supply side, major iron ore miners posted strong production growth in 2021-22 and announced positive guidance for 2023, which will work to limit the upside for iron ore prices.