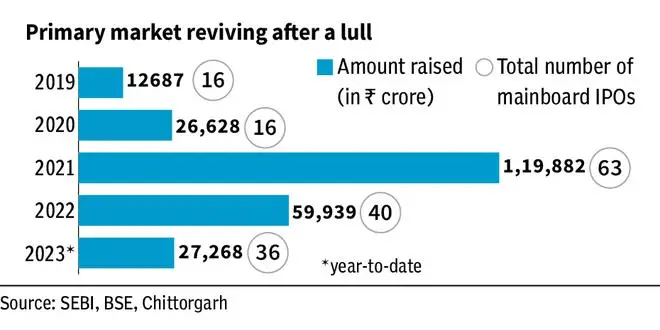

2023 was not a year for IPOs. There were no bigbang IPOs such as Life Insurance Corporation or a flurry of new-age companies listing in the capital market. But the year is silently turning out to be a big one for companies emerging from India’s smaller towns.

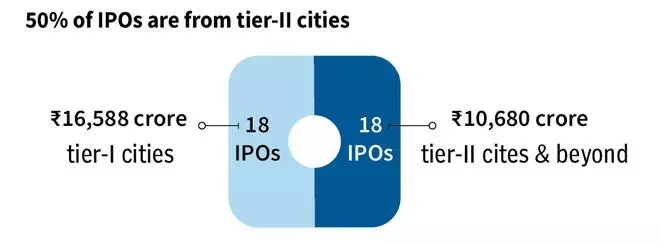

As per BSE data, the Indian capital market saw a total of 36 mainboard IPOs between January and now, with companies raising over ₹27,000 crore. About half or 18 of these IPOs are by companies located in tier-2 cities and beyond. These companies come from Agra to Jodhpur and Gurugram. In monetary terms, these companies together raised ₹10,680 crore or 40 per cent of the total money raised across all mainboard IPOs so far in 2023.

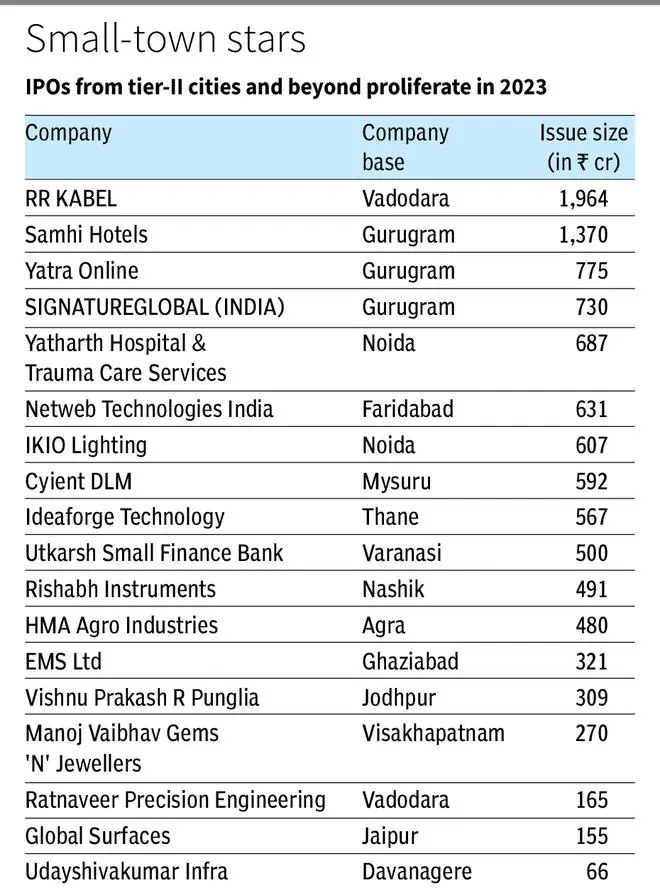

Take the case of RR Kabel. The wires and cable manufacturing company from Vadodara, Gujarat, raised ₹1,964 crore through its initial offer, which is the second-largest IPO fundraise in 2023.

Samhi Hotels is another company from the tier-2 city of Gurugram that raised over ₹1,300 crore. From Davanagere in Karnataka to Faridabad in Haryana, companies across diverse industries made their IPO debut with issue size from as little as ₹66 crore to up to ₹1,000 crore.

Mahavir Lunawat, MD, Pantomath Capital Advisors Pvt Ltd, attributes the growing participation of small-town companies in capital markets to a host of reasons including the entry of next-gen leaders in traditional businesses, increasing participation of retail investors, promotion of entrepreneurship in smaller towns by the government, and simplifying regulatory and compliance processes for listing.

Lunawat said that new-generation entrepreneurs, taking charge of family businesses, want to grow their business in a professional way. “The new generation is open for raising external capital including via the public listing route, which has been a big boost for companies coming from tier-2 and -3 cities.”

He also said the post-Covid boom in retail investor participation in the equity market has also induced companies to tap the capital market route for raising interest-free capital.

The trend of companies from smaller towns tapping the capital market has been picking up in the last few years. In 2022, nearly 12 companies (one-third of the total issues) from tier-2 cities and beyond made their public market debut. These include Tamilnad Mercantile Bank (Thoothukudi), Aether Industries (Surat) and Bikaji Foods International (Bikaner).

While there are multiple definitions, cities are classified as tier-1, -2 or -3 based on the level of development, population the cost of living and other factors. Chennai, Mumbai, Bengaluru, Hyderabad and Kolkata are considered to be tier-1 cities, while Coimbatore, Pune and Ahmedabad are classified as tier-2 cities.

IPO market

The IPO market so far in 2023 was not as vibrant as it was in the previous years. Uncertainty about the rally in secondary market and trouble among start-ups are some of the reasons.

However, from an investor perspective, the year seems to be one of the best ones, as most of the companies delivered gains, including double-digit, on their listing day. Stock prices of over 90 per cent of the companies listed this year are also trading about their issue price.

Lunawat said that the last half of the (fiscal) year looks promising with a robust IPO pipeline. “About 30 companies getting SEBI approval for IPOs where they will collect ₹40,740 core, while 38 with IPO size of ₹43,659 crore still await SEBI approval.”