That slice has been in conversation with Noth East Small Finance Bank (NESFB) merger was known in the banking fraternity. But what has caught many by surprise is the otherwise strict Reserve Bank of India’s no objection to the merger. It was initially believed that the RBI was apprehensive about the fintech increasing its stake in NESFB beyond 10 per cent. Then what tilted the scale in slice’s favour?

Quiet affair?

Perhaps it is slice’s ability to find the weakest link the banking sector. When most of the investors with whom NESFB was in touch with for over two years for capital infusion didn’t want to extend courtesies beyond coffee and a friendly chat, slice, through its non-banking finance company, Quadrillion Finance Private Limited, invested 5 per cent in the bank.

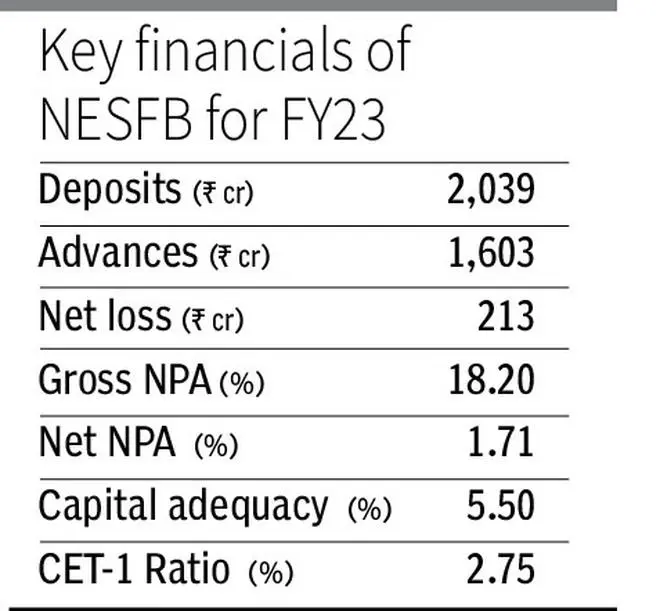

Rajan Bajaj, the fintech’s founder, was quick to find a spot in NESFB’s board. Meanwhile, NESFB’s total capital ratio (CRAR) plunged to 5.5 per cent in FY23 from 17.05 per cent in FY22. SFBs are required to hold 15 per cent capital adequacy, and the bank in its regulatory filing acknowledged that “present CRAR is below the licensing benchmark for which its undertaking all its efforts to raise capital to meet the minimum requirement”.

This isn’t the first instance of a bank failure. YES Bank, Lakshmi Vilas Bank, and PMC Bank were placed under moratorium when capital inadequacy trigger happened in 2020. What’s intriguing and doesn’t meet the eye is why did the RBI approve NESFB’s alliance with slice quietly, without placing the bank under moratorium like it did in the past?

financial inclusion

In the microfinance world, the North-East India is seen as the critical financial inclusion hub. The regulator may have wanted to silently stich a deal before the word went out that another bank was going down the drain. Had it happened, it would have been the fourth bank collapse in just about three years; something which the banking system cannot afford to.

NESFB is barely a mountainous problem. It’s the smallest SFB with loan asset of ₹1,603 crore; its total business (loans + deposits) was ₹3,642 crore in FY23. Had it not been for the extreme portfolio concentration risk with over 73 per cent of its loans originated from Assam, any SFB or private bank would have absorbed NESFB seamlessly.

Since the 2019 flood, followed by a barrage of loan waivers for microfinance borrowers, NESFB’s business has been challenged since FY20. As on March 31, 2023, 18 per cent of its loans were non-performing assets, up from 10.89 per cent a year ago. With its future under serious threat, a deal was definitely in the making. But is slice the best suitor?

Why not slice?

The corporate structure of slice positions it as a technology company in the business of financial services. Promoted by a first-generation entrepreneur and IIT graduate, it offers the promise of innovation. According to reports, the founder’s net worth in 2022 was about ₹950 crore, and firm is said to be valued at $1.8 billion as on March 2023.

Definitely, slice brings in what NESFB was hunting for many years – capital! There is a certainly a peculiarity about the capital that it will bring in, too, and this is what sets the slice-NESFB merger apart from Unity SFB (a joint venture between Centrum-BharatPe). According to data from Tracxn, the company is held by 64 institutional investors. Private equity major Tiger Global’s stake is about 10 per cent, and the large investors include Blume Ventures and Insight Partners. In all, funds hold 66.47 per cent stake in slice. CRED’s Kunal Shah, slice’s angel investor, holds 1.58 per cent, founders hold 8.61 per cent, and employees through ESOPs, hold 20.7 per cent.

This is the most diversified shareholding structure, and one that any banking aspirant should showcase to secure a bank licence. Probably here’s where Sachin Bansal missed out.

Such a diversified ownership structures would have helped slice capture the RBI’s attention and acceptance. But is this enough for execution?

Unknown terrain

Let’s be honest. SFBs themselves aren’t sure if they cracked the code yet. What should give slice the confidence?

Credit cards was slice’s DNA and when the RBI squeezed put the prepaid instruments model, slice’s business went down from issuing nearly 4,00,000 cards a month to zero in November last year. The RBI also came down heavily on State Bank of Mauritius (slice’s banking partner) for its association with the fintech. slice entered the lending business offering loans up to ₹5 lakh for 12-month tenure. But this wasn’t enough to find its lost mojo. NESFB is a blessing for slice, which opens the door to formally resume its cards business, possibly at a lower cost of funds. It can also expand into other segments.

But here’s the catch. 75 per cent of NESFB’s loans should fit in the priority sector lending definition – which would typically be MFI, affordable housing, agri loans, passenger vehicle loans, and small ticket business loans. These are very different from slice was set out to do.

The bigger unknown is the ability to comply with banking regulations.

Last time when it had to toe the line, slice shut shop. In FY23, the RBI imposed a monetary penalty of ₹39.5 crore on NESFB for divergence in NPA reporting, simply implying that neither party to the merger have been successful, should they be regulatorily compliant.

Why merger?

At least ₹300 crore of capital would go down in cleaning up NESFB’s book; plus, in any merger skeletons always come out of the closet.

So, what if slice’s deep pocket is all that is targeted in the merger?

With no prior experience in banking and a very poor track record, neither slice nor NESFB may have a bargaining power in the merger. Will it ultimately lead to the RBI taking the call? It can identify the core management team, have its representatives on the board and put the bank under stricter watch given the bank’s condition.

It will be interesting to watch as to who will have the last say in this unconventional merger.