The IPO of Updater Services opened on September 25 and closes on September 27. As on September 26, the issue was subscribed 0.16 times with retail portion being subscribed 0.7 times. The issue size of ₹640 crore consists of fresh issue of ₹400 crore and ₹240 crore worth offer for sale. The company plans to utilise the proceeds from the issue for repaying ₹133 crore worth debt, ₹115 crore for funding working capital requirements, ₹80 crore will be set aside to pursue inorganic growth initiatives, and the rest for general corporate purposes.

The company is a leading integrated business services platform in India offering facilities management services and business support services, with a pan-India presence.

At the upper end of the price band of ₹280-₹300, the market capitalisation of the company post issue will be around ₹2,001 crore. The PE (price to earnings ratio) of the company post issue will be 57x. The peers of the company Quess Corporation, Teamlease, and SIS Ltd are trading at a trailing PE of 27.7 times, 39.11 times and 18.13 times.

Given the expensive valuation of the company and low margins in a competitive market, investors need not subscribe to the IPO now. It can be considered at some time in future based on its performance as a listed company and at cheaper valuations.

Business and Prospects:

Updater Services Limited (UDS) was incorporated on November 13, 2003. UDS is a leading, focused, and integrated business services platform in India offering integrated facilities management (IFM) services and business support services (BSS) to the customers, with a pan-India presence. The company is the second largest player in the IFM market in India.

The company offers services in B2B (Business to Business) space, and the services of the company can be classified as Integrated facilities management services and business support services. Integrated facilities management and other services include services like soft services (housekeeping and cleaning services), production support services, engineering services, warehouse management, general staffing where field staff are provided to work in various roles under customer supervision, institutional catering, etc. Business Support services on the other hand include services like sales enablement services, employee background verification, audit and assurance services (to ensure the integrity and performance of client’s distribution), and airport ground handling services.

The services offered by the company are annuity-based services i.e., the customer, once acquired, generates revenue over an extended period of time. According to the company, the annuity-based model of the company helps in spreading out the customer acquisition costs and offers the opportunity to cross-sell and up-sell other services, thus resulting in a higher wallet share from customers. In FY23 the share of Integrated facility management services revenue was 71.52 per cent and Business support services revenue was 28.48 per cent. BSS has higher margins than IFM.

The company caters to the needs of diverse customer segments across a range of sectors including FMCG, manufacturing and engineering, banking, financial services, and insurance (“BFSI”), healthcare, information technology/information technology-enabled services, automobiles, logistics and warehousing, airports, ports, infrastructure, and retail, among others. As on June 30, 2023, the company served 2,797 customers across various sectors, including certain marquee global and Indian customers such as Procter & Gamble Home Products Limited, Aditya Birla Fashion and Retail Limited, Microsoft, Hyundai Motor India Limited, Tata Consultancy Services Limited, LTIMindtree Limited.

In addition to growing organically, the company has acquired various businesses over the years, where the strategy has been to acquire and integrate businesses that are complementary to the business of the company.

Through these acquisitions, the company has added services such as employee background verification check services, Audit and Assurance, feminine hygiene care solutions, sales enablement services and airport ground handling services, amongst others, to its service portfolio.

Financials:

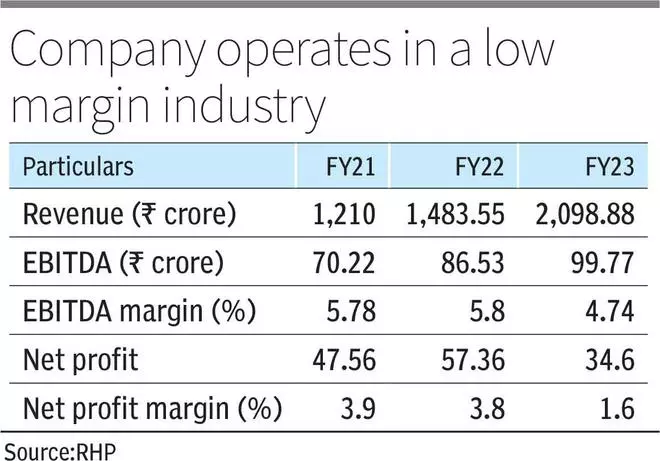

The revenue of the company grew at a CAGR of 31.68 per cent from FY21-23 to ₹2098.89 crore whereas the EBITDA of the company grew at a CAGR of 19.52 per cent to ₹99.7 crore. The EBITDA margin of the company for FY23 was 4.74 per cent and the adjusted EBITDA margin of the company for FY23 was 6.89 per cent (adjusted for ESOP’s and acquisition related charges). The Net profit of the company in FY23 was ₹34.6 crore and the Net profit margin for the period was 1.64 per cent in FY23 which is 3.86 per cent in FY22. The Net Debt to equity of the company is 0.03 times in FY23.