In the past week, the benchmark indices Sensex and Nifty 50 fell by around 2.4 per cent, which might be on account of factors such as the Fed’s hawkish signal, FII selloff and high valuations. Further, most of the sectoral indices fell, with BSE Power and BSE PSU being exceptions. BSE Realty (4.28 per cent fall), BSE Metals (3.25 per cent drop) and BSE Healthcare (3.2 per cent dip) lost the most.

Within the BSE 500 index, Blue Star, Berger Paints, and were among the top gainers during the last week, driven by fundamental reasons in an otherwise weak market.

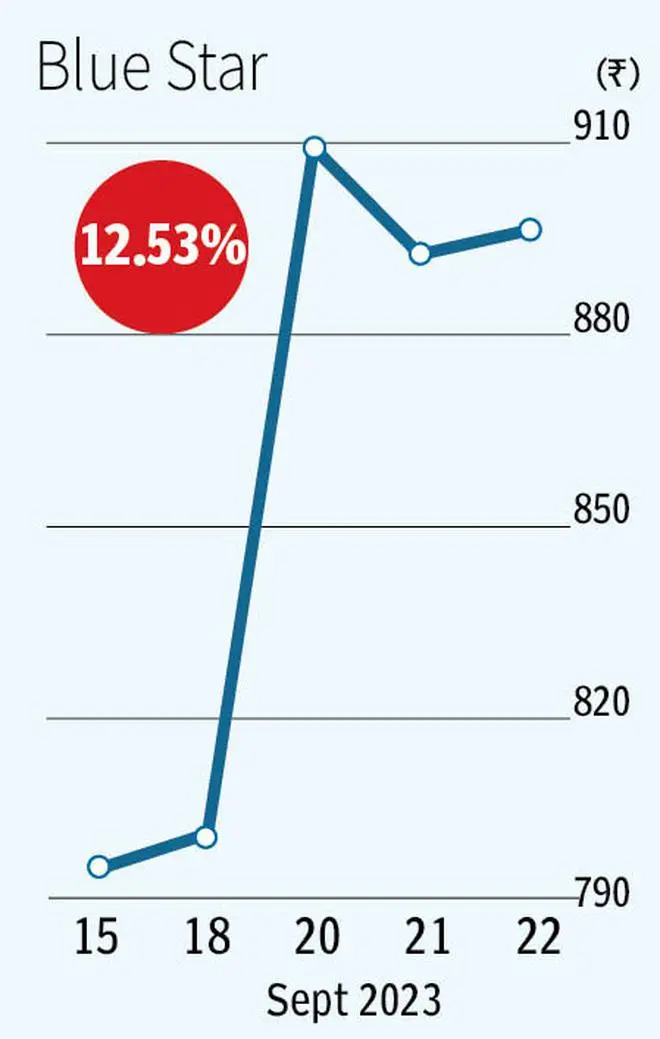

Blue Star

The stock of Blue Star shot up by around 13 per cent in the last week, driven by the company’s plan to raise funds through QIP (Qualified Institutional Placement).

Blue Star Limited manufactures and markets a wide range of air-conditioning and commercial refrigeration systems and products. The company, in an exchange filing on Friday, said that it has raised Rs 1,000 crore through its QIP issue, which opened on Mondaay, in order to fund its growth plans and to retire its debt.

The stock is trading at a trailing P/E of around 42 times.

Berger Paints

The stock of Berger Paints surged by around 11 per cent during the last week. As the record date for the bonus issue fell on September 23, the run-up in the stock during the week was driven by investors buying the stock prior to the record date. .

Earlier, the company’s board declared the issuance of bonus shares in a 1:5 ratio, wherein one bonus share with a face value of Rs 1 each is issued for every five shares with a face value of Rs 1 each held by the eligible shareholders of the company.

The stock currently trades at a trailing P/E of 68 times.

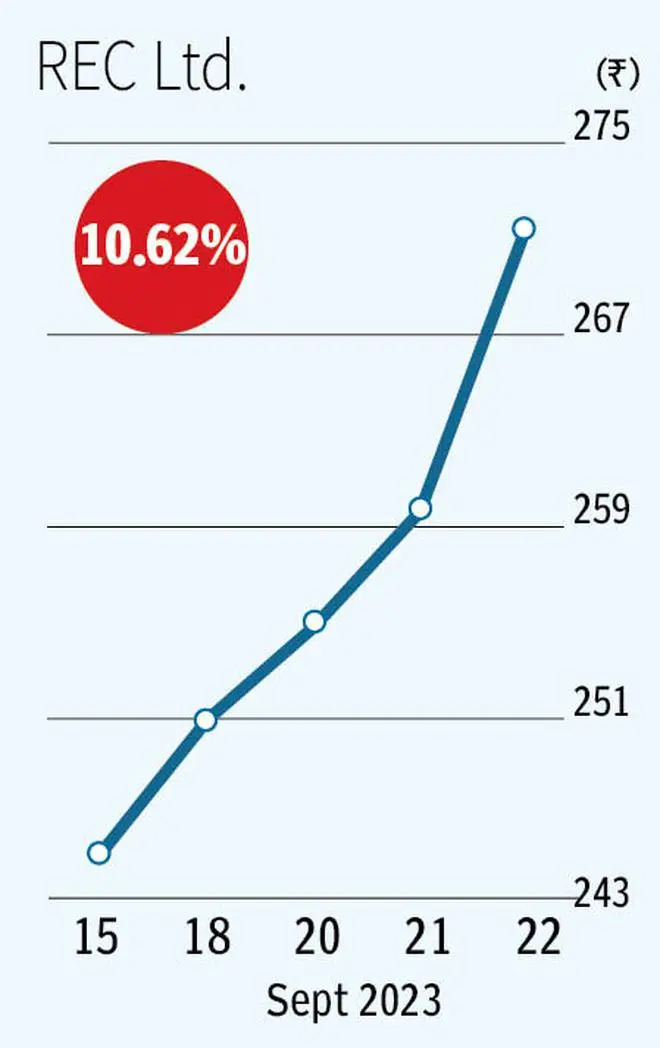

REC

The stock of REC Ltd shot up by around 10 per cent in the last week.

The infra-financier’s board on Wednesday said its wholly-owned subsidiary, REC Power Development and Consultancy, transferred its entire shareholding of 50,000 shares in Beawar Transmission along with its assets and liabilities to Sterlite Grid 27. The stock rode on the successful monetisation of this SPV.

The stock trades at a trailing P/E of 6 times and trailing price to book of 1.85 times.