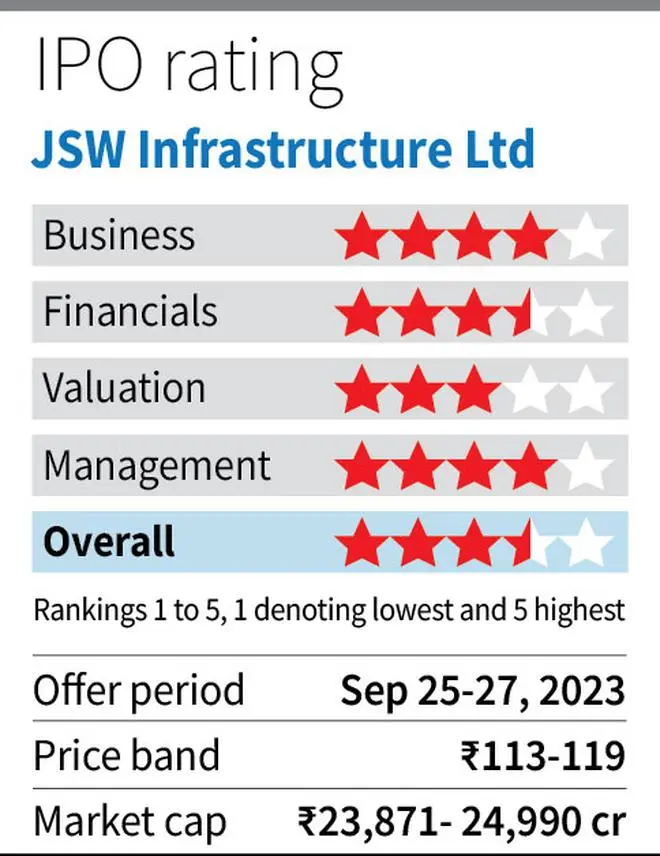

The IPO of JSW Infrastructure opens on September 25, and closes on September 27. The ₹2,800-crore issue is an entirely fresh issue and will be used for following purposes: ₹1,200 crore for capex, ₹880 crore for debt repayment and balance for general corporate purposes.

The company is a major player among the port-related infrastructure developers, it is also the second largest commercial port operator in India in terms of cargo handling capacity in fiscal 2023.

At the upper end of the price band of ₹113-119, the market capitalisation of the company will be around ₹24,990 crore. The enterprise value (EV) post issue will be ₹27,475 crore; the trailing EV/EBITDA will come to 15.12 times. The trailing PE (post issue) is 28.6 times. The company’s listed peer Adani ports is currently trading at a trailing EV/EBITDA of 17.48 time and trailing PE of 33.65 times.

The valuation of the company seems reasonable, given the robust financials, growth prospects and macro-economic tailwinds. Therefore, investors may subscribe to the issue.

Business prospects

JSW Infrastructure is the second largest commercial port operator in India in terms of cargo handling capacity in fiscal 2023 and handled 92.83 million tonnes of cargo in this period. The capacity of the JSW Infra port in India is 158.4 million tonnes per annum (mtpa) as on June 30, 2023, and the capacity utilisation in June 2023 quarter was 63 per cent.

JSW Infrastructure develops and operates ports and port terminals pursuant to Port Concessions. The ports and port terminals of the company typically have long concession periods ranging between 30 and 50 years. As of June 30, 2023, the capacity weighted average balance concession period of the operational ports and terminals is approximately 25 years. The installed cargo handling capacity of the company in India grew at a CAGR of 15.27 per cent from 119.23 mtpa as of March 31, 2021, to 158.43 mtpa as of March 31, 2023.

JSW Infrastructure started as the cargo handling/supply chain arm of JSW group and, of late, has started to serve non-JSW clients also. The share of third-party customers volume has increased to 37 per cent in June quarter from 24.81 per cent in FY21. Within the group companies JSW steel business in June quarter was 40 per cent of the total revenue and the whole JSW group business accounted for 52.5 per cent of total revenue in this period.

The company provides maritime-related services, including, cargo handling, storage solutions, logistics services and other value-added services to its customers, and is evolving into an end-to-end logistics solutions provider.

It has a diversified presence across India with non-major ports (controlled by State governments) located in Maharashtra and port terminals located at major ports (controlled by Central government) across the industrial regions of Goa and Karnataka on the west coast, and Odisha and Tamil Nadu on the east coast.

The company has seven assets in major ports and two greenfield ports; in the major ports it has to follow the port’s tariff guidelines whereas in the greenfield ports developed by it, it can negotiate arbitrary price according to the services it offers. JSW group is the anchor customer of the company which accounted for 63 per cent of business in June and remaining from non-JSW customers.

The company intends to increase capacity at the Jaigarh Port by developing a terminal with a proposed capacity of up to 2 mtpa for handling LPG, propane, butane, and similar products. The proximity of the LPG terminal to the industrial hinterlands and bottling plants of LPG, propane and butane in Maharashtra is expected to provide opportunity in this segment with repeat customer orders. The company also intends to develop a non-major port at Jatadhar (Odisha) with a capacity of up to 52 mtpa to cater to JSW Steel’s upcoming steel facility in Odisha.

JSW Infrastructure is also expanding into synergistic businesses such as development of container terminals, liquid storage terminals, container freight stations (“CFS”), multi-modal logistics parks (“MMLP”) and inland container depots (“ICD”) to provide end-to-end logistics solutions to its customers. In 2019 the company was awarded the concession to develop and operate New Mangalore container terminal from New Mangalore Port Trust which commenced operations in April 2022.

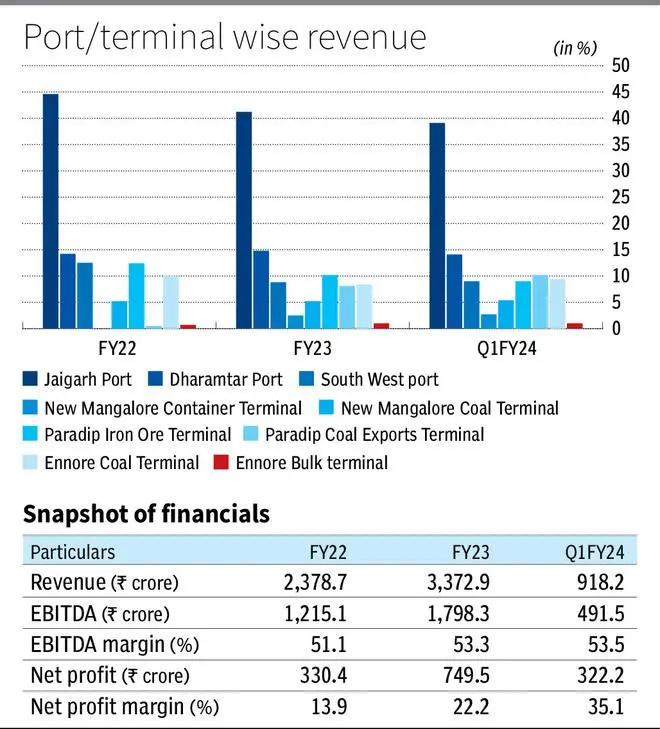

Financials

JSW Infrastructure clocked a revenue CAGR of 41.77 per cent (FY21-23) whereas EBITDA grew at a CAGR of 42.06 per cent in the same period. The revenue in June quarter grew 6.63 per cent YoY to ₹918.23 crore and the EBITDA grew 16 per cent YoY in June quarter to ₹491 crore. EBITDA marginin June quarter was 53.52 per cent which is 134 basis points lower YoY. The net profit margin in Q1FY24 was 35.09 per cent which is 12.72 percentage points higher YoY. The net debtas on June 30 was ₹2,485.2 crore and will further reduce by ₹880 crore post issue. The net debt to equity of the company as on June 30, was 0.6 times.