As markets touch new highs, many retail investors, especially those seeking to enter the market, may be a tad concerned at the elevated index levels and valuations.

Despite the negative aspect of adverse taxation on conservative hybrid funds, this category of schemes may be a useful addition to the portfolio of low-risk investors looking to save for goals that are 3-5 years away. The idea is to beat inflation, and reasonably protect and grow existing capital. The category can also serve as a portfolio diversifier.

Conservative hybrid funds must invest 10-25 per cent of their portfolio in equity and equity-related instruments, while 75-90 per cent must be parked in debt securities, according to market regulator SEBI’s mandate.

In this regard, the SBI Conservative Hybrid fund can be considered by conservative investors with a three to five-year time horizon. It has delivered above-average returns consistently and has been among the better performers in the category. Investment via lumpsums is suitable for conservative hybrid funds, though SIPs (systematic investment plans), too, can be considered over a five-year timeframe, as part of asset allocation towards medium to longer term goals.

Delivering steady performance

SBI Conservative Hybrid, which has been around since 2001 (as SBI Magnum MIP) earlier, has been delivering reasonably healthy returns over the years.

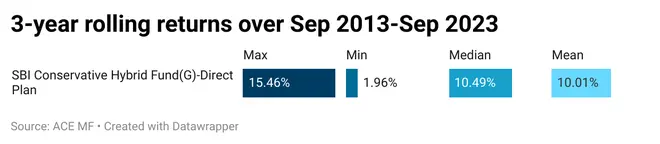

When three-year rolling returns over a 10-year period, September 2013 to September 2023 are taken, the fund has delivered an average of 10 per cent. This return places it above peers such as HDFC Hybrid Debt, Axis Regular Saver, and Franklin India Debt Hybrid.

The fund has not given a negative return in any three-year rolling period over the last 10 years.

It has delivered more than 10 per cent over three-year rolling periods 55.6 per cent of the time in the last 10 years, and 12 per cent returns 30 per cent of the time, over three-year rolling periods during 2013-2023.

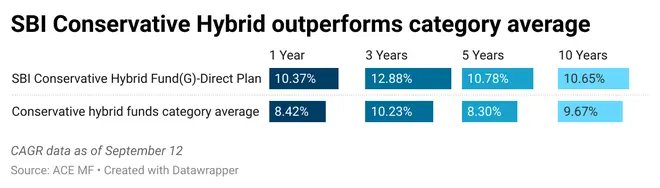

When point-to-point compounded annual returns are considered, the scheme has given a robust 10.6 per cent over the last 10 years. It has generally been in double-digits across timeframes. The fund has outperformed the category average by 1-2 percentage points.

Even SIP returns (XIRR) are healthy at 11.5 per cent over the past five-year period, according to data from Valueresearch.

All gains from conservative hybrid funds are added to investors’ income and taxed at the applicable slab. But if returns are healthy at 9-10 per cent levels, as managed by this fund, the post-tax returns would still be healthy enough to match or beat inflation for even those in the 30 per cent slab.

Smart mix of debt and equity

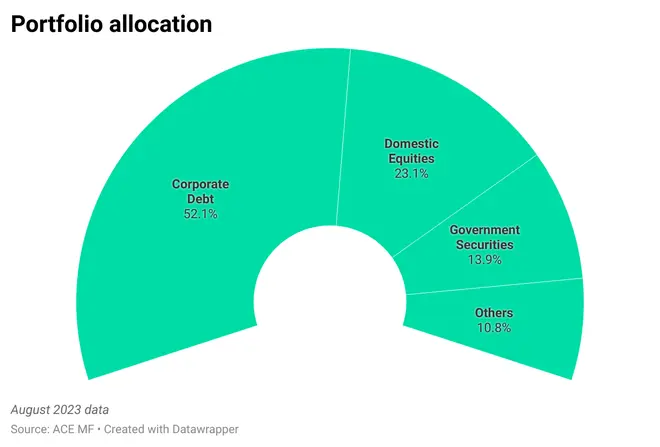

The fund generally allocates 20-25 per cent of its portfolio to equities, depending on market conditions.

SBI Conservative Hybrid takes a multi-cap approach to the stock selection process. So, each of large-, mid- and small-cap segments get 6-8 per cent allocation.

With diffused holdings in stocks, the equity portfolio is diversified across market caps.

The debt portion consists of non-convertible debentures (NCDs), sovereign and state government securities, commercial papers and certificates of deposits. NCDs, both from public sector institutions and private companies, are the main holdings in the debt part, apart from government securities. Larsen & Toubro, HDFC Bank, Tata Communications, SIDBI, NABARD, Bajaj Housing Finance and Mahindra Rural Housing Finance are some of the highly rated NCDs that the fund holds.

SBI Conservative Hybrid also invests in AA rated securities, though these are usually in reputed names or conglomerates. Godrej Properties, Muthoot Finance, Torrent Power, Tata Projects and ONGC Petro Additions are someNCDs in which the fund has invested. Thus, the credit risk in the debt portfolio is quite low.

The fund manages its debt maturity profile actively. From having an average maturity in the shorter and medium durations, SBI Conservative Hybrid has moved to the longer timeframe in recent periods. The average maturity is 9.23 years, and the yield-to-maturity is attractive at 7.81 per cent. The modified duration of 3.56 years is relatively reasonable in relation to the sensitivity to interest rate changes. The fund holds cash and cash equivalents of 5.3 per cent in its August portfolio. Over the past couple of years, the fund has also taken cash & cash equivalent positions of 10-14 per cent when the markets are overheated, or if opportunities aren’t readily available across debt and equity.

Overall, the portfolio is a healthy blend of debt and equity that are low on risk, with potential for above-average returns.