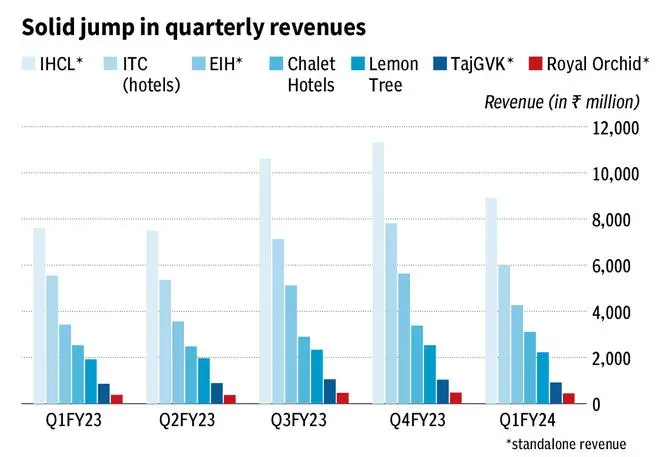

The hotel sector sustained its momentum in Q1FY24 despite the high base. Here are 4 charts that give more insights.

Steady topline growth

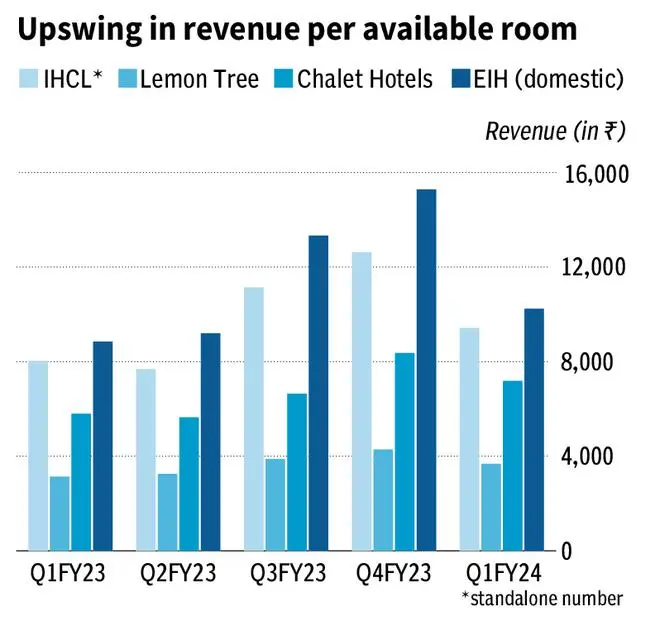

Indian Hotels (IHCL)/EIH/Lemon Tree/Chalet Hotels (Chalet) clocked RevPar growth of 18%/16%/17%/24% respectively.

On a 4Y CAGR basis, IHCL has clocked the highest RevPar growth of 13% backed by its premium brand and its higher share of leisure portfolio. See a similar trend with EIH also.

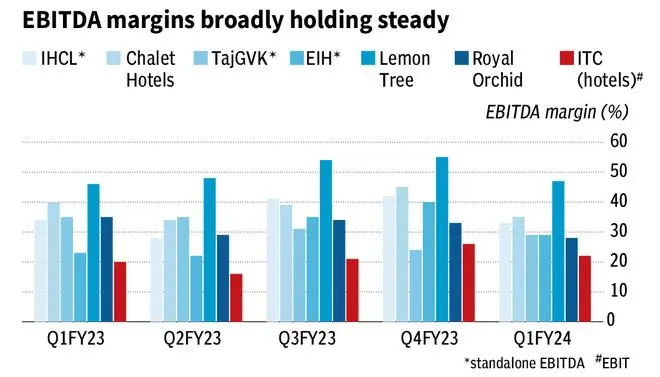

Margin picture

Despite the strong RevPar growth, EBITDA margins for all key players were flat/down YoY (average margin down 127bps YoY) as costs are normalizing, especially towards employee costs and renovation led expenses.

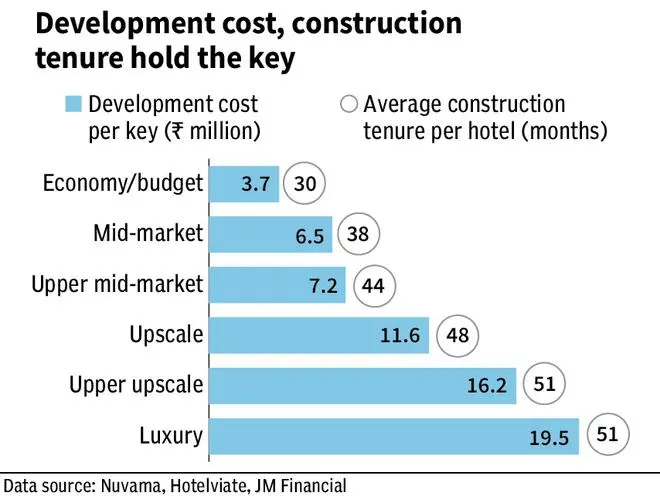

Mumbai market remains the strongest. Similarly, the leisure markets of Goa and Udaipur, while strong are seeing some moderation versus the outperformance in FY23. Hotel building costs and construction tenures have a bearing on industry dynamics.