L Ganesh, Chairman of the ₹6,690 crore Rane Group, a leading Chennai-based manufacturer of automobile parts, is a happy man. And, why not? New order flows for the group companies are robust, while there is some positive news on the two of the group companies that were going through rough patches — one has already turned around and the other one is on the recovery path.

As the automotive and components industry gradually came out of the impact of Covid-19, inadequate availability of chips for vehicles extended the stress for the industry. Also, the Russia-Ukraine war disrupted the global supply chain industry and caused a spike in raw material prices, thereby putting a lot of cost pressure on the companies.

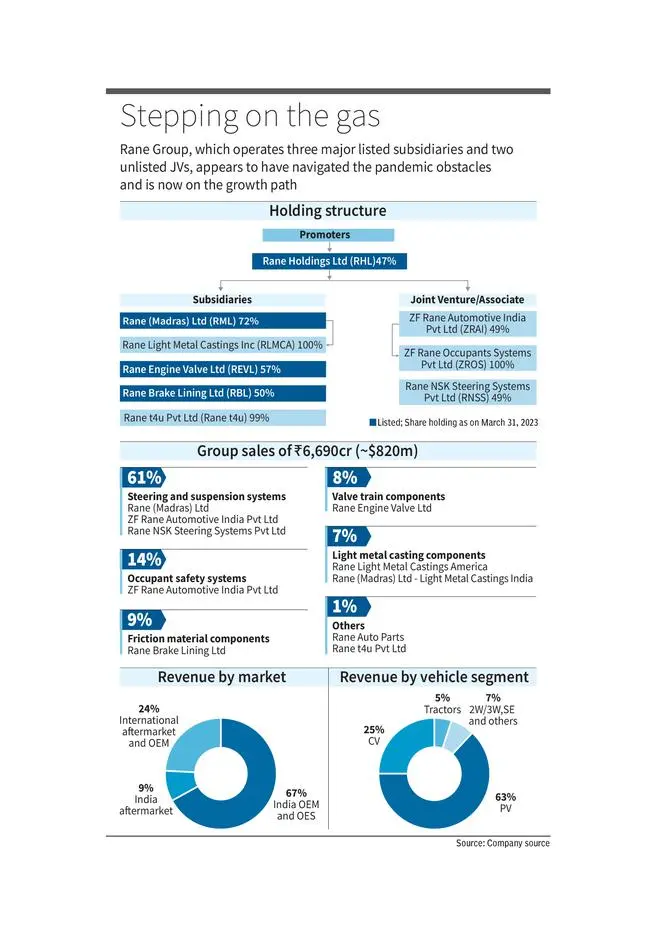

Rane Group, which operates three major listed subsidiaries and two unlisted joint ventures, also went through a difficult phase. For the first time in many years, the group couldn’t prepare a three-year plan which it kicks-off in March. However, there have been improvements in the overall scenario over the past 4-5 quarters in the auto sector amid growing noise over the shift to electric and alternative fuel vehicles. So, FY23 proved to be a strong year for the auto parts industry and the Rane Group.

On growth path

The group has now resumed its three-year growth plan preparation track and has set a target to grow at a CAGR of 10-12 per cent in the next three years. “If the market grows at the current level without any disruption, our growth may even be 12 per cent plus,” says Ganesh.

To drive this growth plan, it has chalked out one of its largest capex programmes in recent years. It has planned to invest ₹1,000 crore capex to boost capacity across product segments including airbags, seatbelts and steering gear, among others, on the back of a surge in the order book.

While the group is bullish on top-line growth, it has also set out a few transformative measures given the latest developments and disruptions in the automotive market. In the global auto parts industry, Global Tier 1 suppliers such as ZF, Bosch and Denso are ramping up their investments in next-generation automotive technologies such as electric and autonomous vehicles. The Rane Group is also evolving a strategy to be a strong globally acknowledged Tier 2 auto parts supplier, prompted by the successful achievement of its goals in the past 4-5 years in building its global image.

“We have now grown to secure about 23 per cent share from international sales. While we set a target to touch 25 per cent, now we are thinking of growing further to reach closer to 30 per cent, which we think is possible in the next 3-5 years, asserts Ganesh.

While the China-plus-one strategy is a reality and driving orders for companies including Rane Group in India, cost pressures in developed markets are also diverting global OEMs towards India as a competitive sourcing hub. “So, we are definitely seeing positive export growth continuing, at least in the next 3-5 years,” he adds

Flexing its R&D muscle

Another major transformative measure of the group is to drive its group companies as deeply R&D-focused operations going forward. “We feel that the inflection point in India has come where companies like Rane must focus on R&D and technology. We are encouraging our companies to develop more technology in-house and have laid out road maps for the same,” says Ganesh.

Also, the companies’ major customers such as Maruti, Tata, Mahindra and Renault-Nissan are seeking rapid response from their suppliers. Gone are the days when suppliers had time to revert.

Barring Rane Brake Linings — which has been spending 2-2.5 per cent of sales on R&D — the average R&D spending of the group companies is 0.5-0.75 per cent of sales. Going forward, the group has chalked out plans to double the current R&D spending.

The Rane Group also seeks to penetrate deeper for big customer acquisitions. Currently, Maruti Suzuki is a very large customer for the group. For example, in electric power steering, Maruti accounts for about 80 per cent of the business.

At a time when domestic and export markets present a positive growth outlook, there is also positive news on the turnaround of two of its entities — Rane Engine Values and Rane NSK Steering, a joint venture with NSK of Japan.

Rane Engine Valves’ business was impacted in the past several times due to two major things. The topline was hit due to the loss of orders as Chinese competition edged out the company on pricing. The operational efficiency of its factories, particularly the older ones in Hyderabad, was poor. As a result, the company lost its business for 4-5 years.

But a turnaround plan comprising a rejig in international business and operational efficiency improvements started paying dividends for the company. “We were also lucky that many of the customers, who went to China 10-15 years ago, started coming back to us as they found us competitive again,” says Ganesh

Bulking order book

In the domestic market, the company has trimmed its focus on high-margin customers. As a result of all these measures, “overall, good progress is being made. Operations have improved, plants are performing better and the top-line is growing. In the last about two quarters, we have become profitable. I think this year will be profitable as we have good orders and we don’t see any difficulty for the next 3-5 years,” says Ganesh.

For Rane NSK Steering Systems, the worst appears to be behind now. This company has been carrying some financial burden in the past four years due to the persistent warranty issue. The warranty provision it had made is reported to be adequate as the claims have started coming down and the period it accepted for free replacement will get over by the end of this year.

Also, the easing of chip constraints has revived its order book and the company expects its sales and operations to improve in the coming quarters. Overall, everything appears to be back on track for this auto parts maker, which is gearing up to get on the growth curve.