Though there has been some minor corrections recently, the Nifty index breached yet another lifetime high late last month The event was marked with the usual combination of celebration and a quiet discomfort — where to from here?

To find out the answer, we looked at how market valuations stand vis-à-vis the expected earnings growth. We also looked at leading sectors within Nifty, their drivers, and what price they are available at.

Here’s what we found:

Nifty 50: Expectations run high

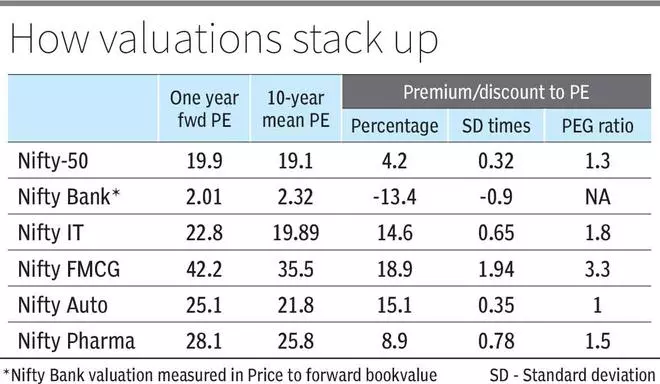

Nifty-50 trades at 19.9 times one-year forward PE, which is a 4 per cent premium to 10-year average of 19.1 times. Measured by standard deviation or SD, Nifty-50 trades at 0.32 SDs above 10-year mean. SD is a measure of dispersion of data from its mean. SD also implies that there is a 68/95/99.7 per cent chance of data points falling within 1/2/3 SDs above or below the mean for a normal distribution. At 0.32 SDs above mean, the current premium is not significant.

But the key thing to note here is that the multiple with a slight premium is being applied to high earnings growth expectations at 16 per cent one-year forward earnings. The index constituents have experienced 13/8 per cent YoY CAGR growth in the last 5/10 years, which implies a high ask rate for earnings trajectory.

Banking, which is close to half of the index by weight, does support such high earnings growth expectations. FMCG, Pharma and Auto, the other major sectors in the index by weight, are also placed to deliver improved earnings growth. But IT could face earnings downgrades as the year progresses.

At the current valuation, if downgrades dominate upgrades in earnings, multiple de-rating can be expected, which will be a double whammy for investors. The lower growth would imply lower earnings expectations which, in turn, would compress the multiples, leading to significant downside risk.

Banking: All drivers in place

Banking, driven by credit growth, NIM (net interest margins) and credit costs, is placed well on all counts.

Compared to the previous decade’s 10-11 per cent credit growth, domestic banks reported 15-16 per cent YoY credit growth in FY23. Retail and housing demand are leading the way. Pent-up demand from Covid and savings and investments from the same period are being levered for credit demand. A revival in housing after a decade is also aiding the sector.

Corporate credit, which has so far lagged retail growth, will benefit as government spending in infrastructure should rub off on metals, cement, and capital goods, sustaining a higher credit demand. As commercial yields have firmed up, credit demand from banks should be attractive. Rural demand recovery is anticipated across all sectors and not just banking, which should add another leg to credit growth.

NIM expansion has played out and a slight moderation can be expected. The banks have repriced loan assets, but the slow creep of deposit rates had fuelled NIM expansion. As credit growth outpaces deposit growth, deposit rates could be repriced for new deposits and existing deposits as well, which will moderate NIM expansion.

The clean-up of loan books, that coincidentally preceded Covid, has led to lower credit costs now. Excess provisioning made during Covid is also unwinding now, adding to the bottom line. Gross non-performing assets, which peaked 8-12 per cent prior to clean-up, have eased to 1-3 per cent for leading banks. Clear guidelines on provisioning, better implementation of technologies in underwriting and a larger retail book (with lower default rates) should sustain lower credit costs, barring a financial shock.

Despite such strong drivers, Nifty Bank is still trading at 2 times one-year forward book value. This is a 13 per cent discount to last 10 years’ average or 0.90 SDs below mean. This can be ascribed to the cyclical nature of growth based on credit cycles (compared to secular growth industries) or to the expected contraction in NIMs. In either case, the significant undervaluation for the industry alongside robust factors supporting growth makes for a strong investment case.

Nifty Auto: In the midst of cycle

Nifty Auto is trading at 25 times one-year forward earnings, which is a 15 per cent premium to 10-year average. But considering the volatile sector multiple, which has a SD of 8.8 times, the current multiple is a reasonable 0.35 SDs above mean. Even measured as a PEG ratio of 1 time, the sector may not seem overvalued.

In any case, the sector, riding on a strong demand, is set to deliver strong growth. The easing raw material case adds a margin lever boosting profit growth expectations.

Mahindra & Mahindra and Maruti Suzuki in 4W segment reported 32 and 22 per cent revenue growth in Q1FY24 and so did Bajaj Auto with 28 per cent revenue growth. The lower cost of RM added 100-300 bps to EBITDA margins for the three companies.

The pent-up demand in the sector extends much before Covid and includes the BS-VI transition phase in 2019, or the downcycle in auto demand prior to that. Even with demand recovery post-Covid, semiconductor shortages, which have been easing only recently, delayed revenue growth.

With a strong order book ranging at 1-2 quarters for companies, the average selling prices (ASP) have also improved by 2-4 per cent for companies. The sector also improved its product mix. SUV preference in 4W segment, EV preference in cars and two-wheelers and premium models in two-wheelers is improving realisations for companies along with a higher ASP.

The scope for further decline in some RM costs may be limited, though, with steel prices finding their bottom after a strong rally last year.

Nifty Pharma: Risk dilution in progress

Nifty Pharma is trading at 28 times one-year forward earnings, which is a 9 per cent premium to its 10-year average. The sector re-rated recently in the last one month by 10 per cent as primary overhangs associated with the sector seem to be easing.

While Indian and Emerging markets have supported the sector, US markets (30-35 per cent of revenues for major players) have been a pain point in the last five years. With excessive pricing pressures in the US playing out, generic suppliers seem to be folding up under pressure, which may benefit existing suppliers led by Indian manufacturers.

Improvement in US FDA plant clearance has also brought down the sector overhang to an extent. The plant clearance rate has improved to a multi-year high of 93 per cent in CY23 so far. Lupin and Aurobindo, which have had serial episodes of serious plant observations in the last five years, are now operating with a largely clean plant status.

Moreover, most companies have developed a value-added portfolio for the US, which is gradually de-risking US revenues from over-dependence on generics. The surge in cash flows in the last two years owing to such portfolio also allows exploring organic or inorganic routes of product development.

Nifty FMCG: Valuation barrier to growth levers

The sector is poised to recover from the pressure of high input costs it faced last year. But increasing competitive intensity and a higher valuation dilute the sector’s attractiveness. At 42 times one-year forward earnings, Nifty FMCG is trading at 19 per cent premium to 10-year average. Even adjusted for sector multiples volatility, this represents close to 2 SDs above mean and a PEG ratio of 3.3 times.

Costs of raw materials, which are essentially crude and palm oil derivatives, increased significantly in FY23 and are on a lower level in FY24. The sector can expect 200-500 bps improvement in gross margins, driven by lower costs in FY24. This would still be 300 bps lower than pre-Covid gross margin range for companies. But the same improvement may not translate to EBITDA margins or lower. As companies pass through lower costs, volume growth may initially lag as trade channels de-stock higher-priced inventory first, which could last a quarter into FY24. Also, companies have to invest on brands as consumption patterns realign from Covid patterns. Companies are also increasingly adding premium products to their portfolio, which will impact operational expenses initially.

Recovery in rural markets has been reported in Q1FY24 on a highly eroded base in the last two years and is critical to FMCG companies’ volume growth. The impact of ongoing monsoons and farm income will be a key monitorable.

While premiumisation and brand investments are positives in the long run, lower volumes initially and lower pass-through to bottom line may limit earnings growth to 10-12 per cent in the next two years, according to Bloomberg consensus. A premium valuation for such in-line growth may impact sector attractiveness compared to other sectors.

Nifty IT: Weak prospects high valuations

Nifty IT trading at 23 times one-year forward earnings is at a 15 per cent premium to its 10-year average and close to 0.65 SDs above mean. The sector can expect low single-digit revenue growth and even lower earnings growth for FY24 as per analyst reports, which cannot be supported by current valuations.

The impact of economic slowdown in North America and Europe has translated to delayed or curtailed projects in Q4FY23 and Q1FY24, which should impact short-term revenue growth. Deal wins, which are longer-term revenue indicators, have ranged from moderate to declining for companies. Currently, most of the project slippages have been from North America region. If it spreads to Europe, the UK and Latin America, it can add to further earnings downgrades — going beyond guidance cuts announced by companies in current quarters. The recovery of such delayed projects will need sound economic outlook in developed markets, which is in short supply currently.

If last year’s exuberance was built around cloud and digital transformation projects, this is now replaced by generative AI projects and machine learning. But the associated employee cost and pilot stage of projects, along with attrition-related costs, will likely impact margins by 200 bps already reflected in Q1FY24 earnings.

Overall reasonable valuation for strong growth is visible in banking sector. Auto and pharma may be overvalued, but growth visibility is also stronger. FMCG sector is overvalued but with investments into brand building and portfolio premiumisation, earnings growth in the long term could be stronger. IT is the only sector with a weak outlook but a higher valuation premium. At an overall market level, though, high earnings expectations for the Nifty with valuations at a slight premium to long-term average do not leave much room for disappointments.

How companies navigate the current global environment will be key to what direction the market takes. The recovery in rural employment and economy is crucial to sustain volume growth across sectors.

Global factors

The global macro environment may be thawing its way out of a probable recession, but challenges persist. The implications for Indian companies in the current global environment will be a mixed bag.

IMF has revised global growth outlook downwards for 2023 and 2024 to 3 per cent from 3.5 per cent in 2022. Global inflation peaked last year and is coming off. But the inflation print of key economies such as the US and the UK continues to stay at a level where central bankers continue to stick to a hawkish stance.

Although oil prices have cooled off compared to a year ago, they have been on the rise in recent times. A further rise will bring inflation-led recession back into the picture. Even if energy prices are lower, energy taxes are pushing cost of manufacturing in developed economies and even China to a higher level. Then there is the ‘Decoupling’ phenomenon. UK Brexit, continuing US China trade disruption, Europe-Russia and emerging fissures in Europe-China will lead to under-utilisation of assets and indirect inflation. Demand implications for Indian companies are positive from energy inflation and decoupling. Without an excessive levy on energy or pollution control costs, domestic steel, chemicals, pharma, and auto exports will stand to gain. The decoupling implies that a portion of global trade should and is finding its way to domestic manufacturing.

Persistent global inflation would imply higher G-sec yields starting with the US, which will have an effect on global asset prices. US 10-year bond yields have risen by 270 bps in the last two years. With inflation persisting above target bands despite rate hikes, persistent high yields cannot be ruled out. The higher yields and hence higher risk-free returns will push up the discounting rate for Indian companies, which is a negative. The current earnings growth expectation of 16 per cent for Nifty-50, which comes at a slightly premium valuation, will be increasingly compared to risk-free returns exceeding 7 per cent domestically and 5 per cent in the US.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.