The recent changes in debt fund taxation rules may force mutual funds to reduce their exposure to non-banking financial companies (NBFCs). But non-banking lenders will face little impact, as many have already reduced their dependence on mutual funds and turned more to bank loans, fixed deposits (FDs), and overseas borrowing.

In an amendment to the Finance Bill, the government last week removed the 20 per cent long-term capital gain and indexation benefit on certain categories of debt mutual funds from April 1.

As a result, capital gains from debt funds, international funds, and gold funds will be taxed at the individual income tax slab rate. Many expect this will reduce inflows into debt mutual funds as investors may look for alternatives like FDs and alternative investment funds (AIFs) with higher post-tax returns.

Also read

Consequently, mutual funds, a major subscriber to NBFC debt instruments like non-convertible debentures (NCDs) and commercial papers, will have fewer funds for these instruments.

“There will definitely be concern here because the ability of mutual funds to invest in debt depends on the extent to which individuals and corporates subscribe to debt schemes. Assuming that they withdraw from debt schemes, there will be a challenge for sure,” said Madan Sabnavis, Chief Economist, Bank of Baroda.

Right mix

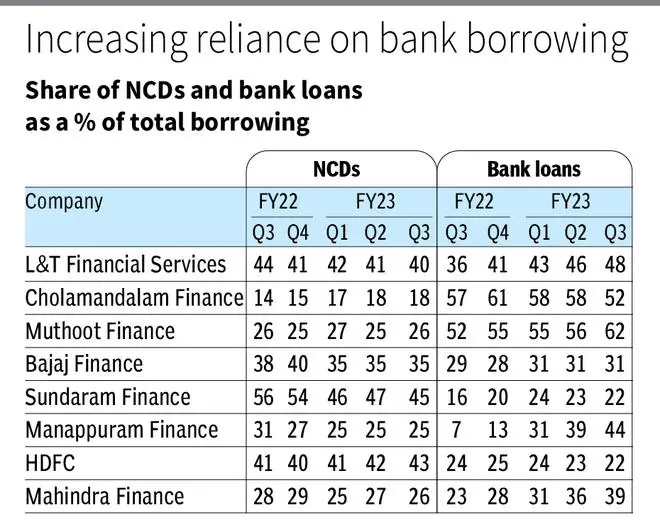

However, an analysis of NBFCs’ borrowing shows their fundraising through NCD issuances is anyway falling even as bank lending is rising consistently. Take Sundaram Finance, for instance. The share of NCDs has fallen from 56 per cent of total borrowings in Q3FY22 to 45 per cent as of Q3FY23. During this period, bank loans as a percentage of total borrowing grew from 16 per cent to 22 per cent.

Manappuram Finance, L&T Financial Services, Mahindra Finance, and Bajaj Finance have all reduced their fundraising through NCD issuances during this period, while the share of bank loans went up.

Noteworthy is the borrowing mix of the gold loan from NBFC Manappuram Finance, whose share of bank loans spiked from 7 per cent in Q3FY22 to 44 per cent in Q3FY23, even as its NCD share fell by 6 per cent.

Shrinking exposure

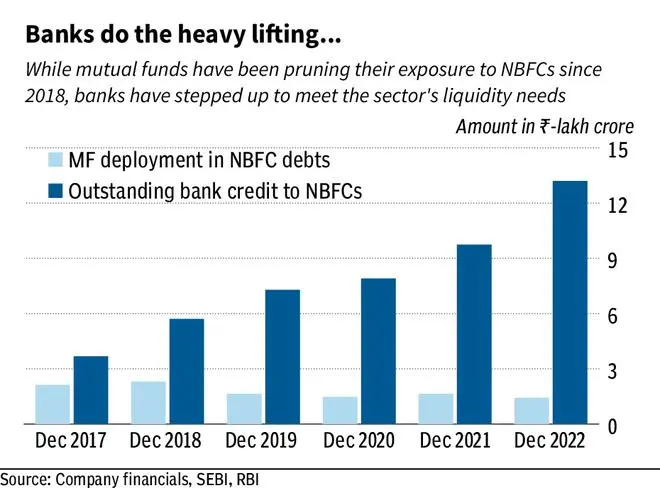

NBFCs’ increased reliance on bank borrowings and other sources of funding began in 2018 when mutual funds began to cut their exposure, shaken by a series of defaults in the sector, starting with IL&FS. Mutual fund deployment in NBFC bonds and commercial papers has sharply fallen from ₹2.31 lakh crore as of December 2018 to ₹1.43 lakh crore at the end of December 2022. Outstanding bank credit to NBFCs witnessed a four-fold jump to ₹13.20 lakh crore during this period.

Jugal Mantri, Executive Director & CEO, Anand Rathi Global Finance, said from 40 per cent in CY2018, mutual fund holdings in NBFC debt have already come down to 10 per cent by December 2022. “I do not see any negative impact of LTCG benefit withdrawal on short/low/ultra-short duration funds, as well as liquid and hybrid funds. LTCG benefit withdrawal impacts will be restricted to only long duration and corporate bond funds,” he added.

Besides bank loans, NBFCs also have a well-diversified liability mix, including external commercial borrowings (ECBs), retail deposits, public issue of retail NCDs, and securitisation, among others.

Overseas borrowing

Indian corporates, mainly NBFCs, have raised ₹8,726 crore in public issues of NCDs in the current fiscal. Bank of Baroda’s Sabnavis said NBFCs may have to offer higher interest rates to attract direct customers. This means their cost of funding will go up.

On raising resources through ECBs, Sabnavis said, “It does look likely that they will have to borrow more from banks as ECBs may be more expensive as interest rates have been increasing in the West.”

Mantri said banks annualised credit growth to NBFCs is more than 35 per cent in CY2022. “Banks have enough appetite and willingness to meet the increasing requirements of NBFCs.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.